The UK Asset and Wealth Management industries continue a strong consolidation trend with M&A activity being driven by the desire to reduce or mitigate increasing regulatory compliance and operational overheads in an environment of ongoing high inflation. Firms are being buffeted by increasing administration costs, platform and consultants pressure on fees reducing profit margins on conventional ‘long-only’ asset classes, and increased competition at both ends of the investment spectrum, from the index tracking passives and quant shops cutting fees to the bone, to the specialist private markets alternatives in Private Equity and Private Credit stealing the cream in the high margin domain.

The most recent case in point being Rathbones’ £839mn deal to buy Investec Wealth & Investment UK where a key management objective would be to eliminate £60mn in costs by sharing resources and shrinking headcount.

The big ‘history-making’ event over H1 was of course the catastrophic blow-up of Credit Suisse and associated take-out by UBS, impacting thousands of employees across the investment banking, asset management and wealth management business units. Whilst the final numbers still need to be verified, it is possibly that more than 30,000 jobs may be on the line globally due to organisational duplication and aggressive cost-savings by the new UBS leadership. This will likely have a material impact on the London market, as both top talent and those considering themselves vulnerable will re-assess their future prospects. Companies keen to add depth and experience should consider this a unique buying opportunity to cherry pick some of the best talent in the market.

A key take-away for candidates from all this M&A activity, is to debunk the myth that a career in a large company is a ‘safer bet’ to build your career. The stark reality is that after long and loyal service, you can quickly be deemed superfluous to requirements and discarded with scant regard to your future.

As a smaller investment front-office market, Dublin is largely protected from the ongoing M&A activity in the UK, and being the only English-speaking country in the EEA, continues to attract US firms seeking access and exposure to Europe. Smaller specialist boutiques offering select private markets solutions into the Irish, UK and European markets are likely to thrive – given lower cost based and sales of higher margin product/Funds.

It is evident that on a global scale, the professional asset allocators (pension investment consultants, wealth managers, multimanagers, family offices etc) continue to advocate for increasing allocations to private markets alternatives – notably into private credit strategies. This bodes well for firms focused on these sorts of strategies.

Counteroffers:

Counteroffers are at an all-time high as companies struggle to retain and attract talent. Over H1 we have seen several individuals receive counteroffers, with money not always being the deciding factor. Understanding the costs of replacing experienced professionals, firms have deployed a number of tactics to retain their best talent, such as offering them exposure executive mentorship and coaching, access to a broader range of responsibilities or other departments, promotions, or flexible working. Money is not always the deciding factor, however, the increase in counteroffers has increased salary expectations, especially at the early career professionally qualified level.

Hybrid working – settling into the new regime:

Through H1 it became clear that there are 3 different ‘types’ of companies:

- US HQ’d and culture led firms where the central mission is to try resume 5 day working weeks

- European HQ’d and culture led firms with a more ‘adult-adult-trust’ open-minded mindset typically 2-3 days in the office

- UK/Ireland firms which have settled on an ‘average’ of 3 days in the office.

The record high inflation rate in the UK, rapidly escalating interest rates and consequential impact on workers’ cost of living budgets will continue to pressurise employers who have generally not paid inflation matching or inflation beating increases in Q1, into maintaining some form of hybrid work policy in order to mitigate against employee’s transport costs.

Global inflationary pressures:

This above chart looks at global inflationary pressures. The left-hand chart shows that the competition for workers has dramatically increased post-pandemic. The challenges that firms have faced in finding staff raises the likelihood that they will hoard workers even if activity levels slow. This tightness in the labour market partly explains why core inflation remains elevated across the US, eurozone and UK, as shown in the right-hand chart.

A major challenge in the Dublin market remains the housing crisis, with miniscule available supply of residential accommodation, particularly for mature candidates with families. Companies that cannot source their required talent locally are stressed to conclude hiring processes with ‘out of town/country’ candidates who may not be able to secure suitably convenient accommodation.

Hybrid working in Dublin therefore offers some respite to those employees who may, through sheer necessity, live a long-way from the city off major public transport commuter routes and have a legitimate need to work remotely most of the time.

Salary expectations:

The long-forgotten economics forecasts that ‘inflation is transitory’ have recently been replaced by ongoing concerns about the escalation and the ultimate ceiling of interest rates – which have now materialised into a genuine salary deficit for most employees who did not win ‘real’ increases over the past two years. Employees are increasingly being compelled to consider a job move in order to secure an inflation beating increase in their earnings. This thinking is now driving demands for salary increases above inflation especially from top talent with scarce skills, experience and qualifications.

For new hiring, it is not unusual for candidate to expect a 15% to 20% pick-up in salary above existing, and if this level is not put on the table, serious risks exist to have your desired candidate counter-offered.

Eurozone labour market:

The above chart zooms in on the eurozone labour market. The chart considers the relationship between unemployment and wage growth. Tight labour markets are currently helping to drive wages higher.

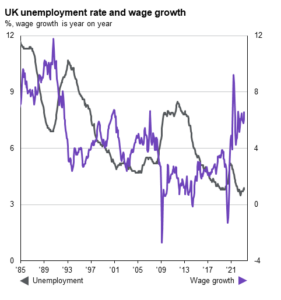

UK consumer and labour market:

Source: J.P. Morgan Asset Management, ONS, Refinitiv Datastream. Wage growth is a three-month moving average of average weekly earnings for the whole economy, including bonuses and arrears.

The above chart focuses on the consumer and the labour market in the UK. On the left-hand chart we show a measure of consumer confidence plotted against business surveys of the services sector. The slump in consumer confidence has so far been much sharper than the slowdown in services activity. On the right-hand chart, we plot unemployment against wage growth. Historically a tight labour market has coincided with strong wage inflation, and we see similar dynamics at play today.

Looking further afield:

Notwithstanding the sterling’s poor performance relative to the euro, there continues to be a salary arbitrage between London and Dublin, typically in the 10% to 20% range depending on role and experience.

UK firms looking for top talent are encouraged to consider Irish candidate profiles – there is an available pool of exceptional talent in Ireland, many of whom would be keen to transition their careers to London. It makes good commercial sense to consider these candidates who have comparable skills, qualifications and experience, but come at a 10% to 20% discount relative to their UK counterparts.

Sponsorship:

Notwithstanding the available talent in both London and Dublin, it is possible to source exceptional individuals who have chosen to relocate for tertiary education, or permanent immigration reasons.

Working visas/sponsorships should not be a major deterrent to potential employers. A frequently forgotten benefit of sponsored employees is that they are effectively ‘locked-in’ for a defined period.

This can be a great retention tool for prospective employers and can build loyalty with the employee over time. Additionally for those candidates who have recently completed tertiary education, typically at Master’s level, their skills and expertise can usually be secured at a meaningfully lower cost compared to ‘local’ talent and furthermore, these individuals can frequently be secured on an ‘immediate hire’ basis, thereby reducing the time to hire by up to 2-3 months.

Interim solutions:

At Coopman we also provide interim solutions to our clients. This looks at hiring experienced professionals/consultants on a contract basis. This can be a time efficient way to secure a candidate and has proven to be a very successful method of hiring candidates locally and outside of Ireland.

Recruitment processes:

Our advice to employers who are currently or intend on hiring over the coming months:

- Avoid offering a lesser salary than candidate expectations (within reason) – get the full breakdown of current salary & benefits and ensure to offer an attractive package.

- If you like a particular candidate, keep the process moving swiftly and close quickly or there will be a risk of losing the candidate which will ultimately end in a long and frustrating process.

- Encourage in-person interviews, it will give you the best opportunity to learn about your candidate, sell the opportunity and demonstrate your company culture & showcase your office.

- Lastly, we advise a wet signature (in-person signing) as it significantly increases the candidate’s commitment and provides you with an opportunity to reinforce company values, view the workplace and it is a fantastic opportunity to meet their new team also; even for a casual drink afterward.

Although there are economic and operational environmental challenges on the horizon for the remainder of 2023, combined with the notorious ‘summer months’ slowdown, there will always be the need to source top talent to replace organic vacancies or to meet business growth challenges. As seasoned experts in the investment front-office markets, with expansive networks across the length and breadth of the UK, Ireland and Continental Europe, you can count on Coopman to assist you in finding the best talent.

If you would like to discuss the above or how we can support your hiring processes in the current market, please get in touch with Principal Consultant Gareth Connellan at gareth.connellan@coopman.ie